Markets & Investing

Liquidation of Midas Holdings' subsidiaries gets go-ahead

Midas said it is insolvent, its assets are not enough to cover its reported liabilities and prospects of rescue appear dim.

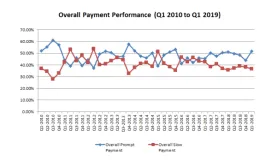

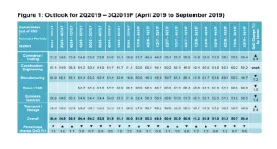

Half of firms paid their dues on time in Q1

Apart from the construction sector, slow payments have improved across four industries.

Daily Briefing: Luxury home prices down to all-time low at 2.9%; Taxpayer money will not be used to aid Hyflux investors

And Singapore-based offshore & marine company Swiber bags $200m from Seaspan Corporation.

China slowdown to weaken APAC cross-border sentiment in 2019

Chinese corporates' onshore funding costs are forecasted to fall further.

Keppel Infrastructure Trust to raise $200.79m in preferential share offering

The offering will close on 4 April.

Malaysia-based Fortress Minerals debuts on Catalist board at $0.22

It produces iron ore concentrate sold to firms in China and Malaysia.

Sinarmas Land-Rongqiao Group joint venture to invest $44.7m in Taicang Rongguan Real Estate Development

The investment will boost Sinarmas Land’s property development footprint in China.

Daily Briefing: Singapore law firm clears Wirecard of some corruption claims; Temasek invests US$29m in Vietnamese Internet major VNG

And tech-enabled student housing startup Oxfordcaps raises $11m in series A funding.

First Sponsor Group to undertake rights issue for $399.5m

It dropped its initial plan to issue warrants for perpetual capital securities.

Daily Briefing: Singapore's credit market bore the brunt of regional distress; ERA Realty Network gives $1m grant to real estate startups

And London-based regtech firm ClauseMatch expands in Singapore.

SMEs open to business transformation investments amidst souring economic expectations: poll

The manufacturing sector saw the highest uptick in capital investment expectations by 2.15%.

Pine Capital requests for trading suspensions as its subsidiary causes potential conflict of interest

The group will appoint an independent reviewer to investigate the allegations.

Daily Briefing: GIC and Temasek ate up 60% of sovereign fund deals in 2018; Singaporean PE firm Tembusu Partners invests $201.4m in Chinese projects

And luxury property Boulevard 88 sold 20 out of 25 units for $3,550 psf.

MAS reopens $2b of the 5-year SGS bond

Intended tender amount is at $100m and the minimum denomination is at $1,000. The Monetary Authority of Singapore (MAS) will re-open $2b of the 5...

Challenger Technologies to delist with $0.56 exit offer price

It cited weak retail sentiment and industry disruption amongst its reasons for delisting.

Raffles United Holdings gets SGX nod to list 234.06 million new ordinary shares for $0.05 apiece

The rights issue could raise between $7.6m-$11.6m in net proceeds.

Advertise

Advertise

Commentary

Liquidity crucial to stock market reform

From ownership to access: Unlocking vehicle productivity in Singapore

Why Singapore schools need AI policies now: A chemistry teacher’s warning