Markets & Investing

Singapore joins top 20 economies in investment appeal

Singapore joins top 20 economies in investment appeal

Economies with the highest GOI scores were all high-income advanced economies.

Amsterdam’s Bouwinvest pours US$75m into CLI’s lodging private fund

The private fund has a target equity size of $800m (US$596.04m).

Starwood acquire 10.7% stake at ESR Group

ESR Group has $156b worth of assets under management.

Second Chance Properties warns of ‘significant’ decline in net profit

The company had unrealised foreign exchange losses in 1H24.

FHT turns down offer to acquire Capri by Frasers, citing strategy mismatch

The property has a 45-year lease remaining under JTC.

FLCT prices $175m Series 002 notes at 3.830%

The bonds are due in five years.

CLI debuts sustainability-linked panda bond, raises $187.1M

The panda bond was 1.65 times subscribed.

Manulife US REIT taps John Casasante as CEO and CIO

Casasante’s appointment is still subject to regulatory approval.

Singapore deal activity falls 13.2% YoY in the first 2 months of 2024

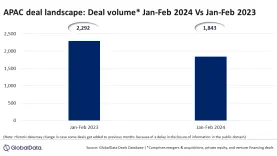

In the whole of APAC, deal volume declined by 19.6% YoY.

RHB raises target price for Singapore Exchange

Securities trading remains weak.

Venture capitalists sharpen focus on targeting startups’ profit paths

Deal activity in Asia Pacific fell 26.3% YoY in 2023, but an expert suggests that years after a ‘bad year’ are always ‘exceptionally good.’

Yangzijiang Financial restructures, eliminates Chief Risk Officer role

The firm will re-assign its current CRO to Cash Management operations.

Trustee-manager of Dasin Retail Trust hits back at former CEO and creditor with legal suit

The former CEO and creditor earlier filed winding-up applications against the trustee manager.

Singapore leads the women-led startup landscape in SEA

Singapore ranks 7th in the world’s most funding raised by women-led startups.

Seatrium listing granted in-principle approval by SGX-ST

This involves 3.4 billion consolidated shares listed on SGX-ST Mainboard.

SGX derivatives trade volume climbs 24% in February

SGX MSCI Singapore Index Futures volume gained 10% YoY.

Yestar Healthcare cancels US$197.86m senior notes issue

Redemption date for the senior notes is on 13 March 2024.

Advertise

Advertise

Commentary

Liquidity crucial to stock market reform

From ownership to access: Unlocking vehicle productivity in Singapore

Why Singapore schools need AI policies now: A chemistry teacher’s warning