Markets & Investing

SGX to launch interest rate derivatives in H2

SGX to launch interest rate derivatives in H2

These features link Singapore and Japan’s interest rate derivatives.

Ascott REIT issues $120m notes due 2029

The notes are priced at 3.69% per annum.

What are the top 5 needs of Singapore-based SFOs?

Nine in 10 want solutions that allow a comprehensive view of their total wealth.

Jardine Matheson’s net profit soars to US$686m in FY23

Full-year dividend also increased, jumping 5% YoY.

Trustee-manager of Dasin Retail Trust hit with new demand letter on alleged outstandings

The trustee-manager allegedly owes Sun Shu $99,139.13 of director fees.

Wing Tai Holdings launches $1b multicurrency debt issuance programme

Proceeds will be used for general working capital, investments, and refinancing existing borrowings.

Wing Tai Holdings Limited has initiated a $1b...

SG-based data scientists earn more than their SEA peers

The base salary range for data scientists ranges from US$3,600 -US$8,400 monthly.

3 key challenges in establishing single-family offices in Singapore

Eight in 10 SFOs in Singapore need secure infrastructure and IT security.

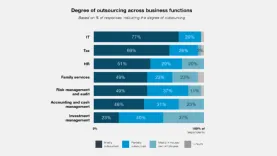

Majority of SFOs in Singapore outsource business functions

One of the business functions SFOs outsource is IT (77%).

CapitaLand aims to grow Vietnam residential units to 27,000 by 2028

CLD plans to focus on large-scale projects in Hanoi, Ho Chi Minh, and Binh Duong.

SGC to back local, ASEAN companies expanding into Baden-Württemberg

Baden-Württemberg has attracted over 6,500 foreign firms.

Elite REIT bags £135m debt facilities

The REIT will use the fund to refinance its existing loan facilities.

Singapore unit trusts swing to $998M net outflows in Q4

Analysts are cautiously optimistic for both stocks and bonds this year.

Paragon REIT declines acquisition offer for The Seletar Mall

The REIT cited the potential dilution of DPU as a factor that led to the decision.

Gov’t to roll out 'Tender Lite' in April

The category will cover tenders up to $1m for general goods and services.

Far East Orchard triples net profit in FY23

Net profit for the period was $66.0m.

Yangzijiang Financial net profits up 25% to $201.8m in FY2023

A dividend payment of S$0.022 per share has been proposed.

Advertise

Advertise

Commentary

Liquidity crucial to stock market reform

From ownership to access: Unlocking vehicle productivity in Singapore

Why Singapore schools need AI policies now: A chemistry teacher’s warning